A Brief Overview of KYC Requirements for Foreign Exchanges in EMEA

BEFORE YOU GO...

Check how Shufti Pro can verify your customers within seconds

Request DemoNo thanks

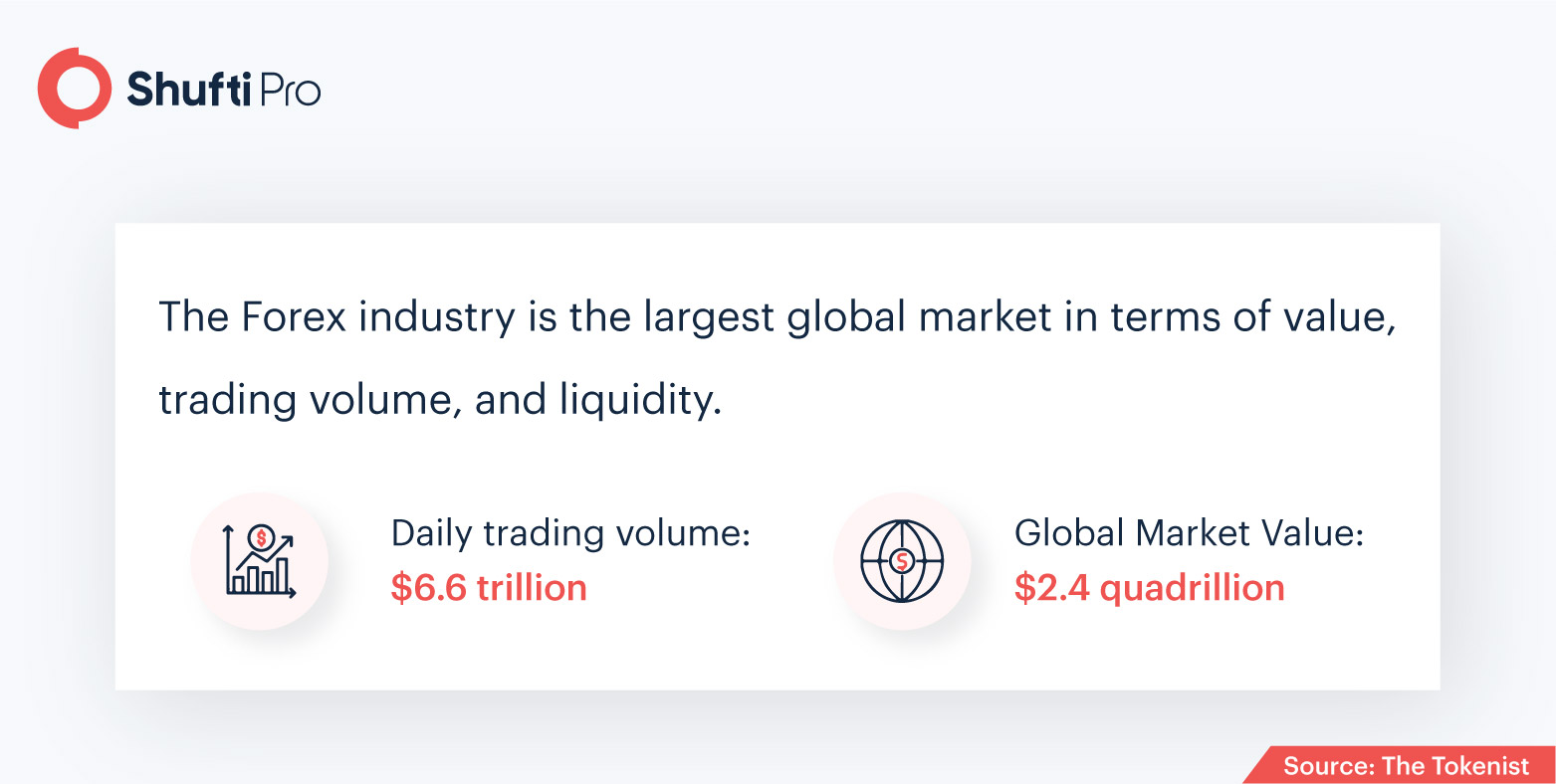

The forex industry is recognizable for being a dynamic and profitable platform due to its high liquidity and trading volume. Even when the COVID pandemic was negatively affecting the overall market, the increased global volatility only resulted in a rise in forex trading volumes. However, forex trading isn’t risk-free and is often maligned due to criminal activities. In addition to the risk of money laundering and terrorist financing, the forex industry also faces losses due to compliance penalties.

Various forex companies find it tough to achieve the balance between KYC compliance, fraud prevention, and generating sufficient revenue at the same time. With its ever-increasing trading volume, the forex industry is an obvious target of fraudsters looking to launder money and for other illicit activities. Considering this situation, KYC and AML restrictions are becoming more stringent to ensure the prevention of fraud in forex trading.

KYC or Know Your Customer is a system to carry out customer identity verification to ensure that only legitimate customers are onboarded for the purpose of fraud prevention. Enhancements in technology have led to the development of AI-driven KYC solutions that verify identities by authenticating facial features through biometric facial verification and simultaneously verify government-issued ID documents.

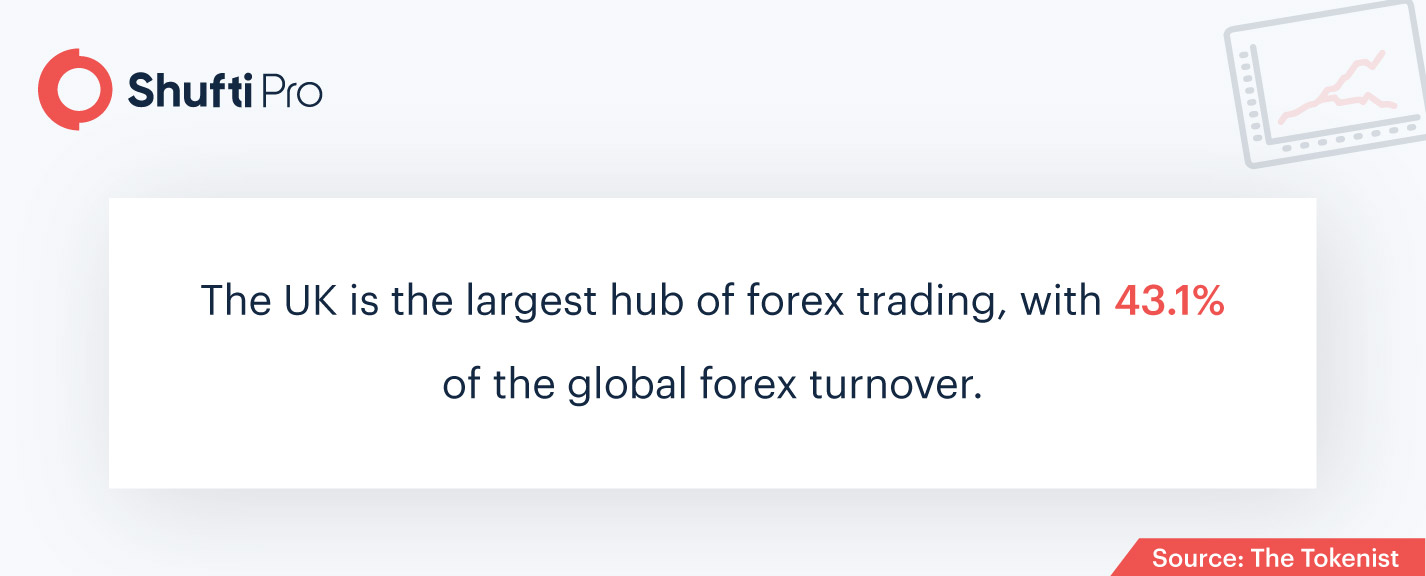

Forex trading is a dominant part of the global financial landscape, which justifies the numerous sets of regulations that apply to forex platforms across the globe. Depending on regions and types of forex platforms, the regulations primarily require the implementation of KYC services and customer due diligence protocols. Digital ID verification during customer onboarding allows forex companies to filter out fraudsters and eliminate fake identities from their system.

Forex companies, however, often shy away from incorporating KYC services assuming that their transactions and processes will be slowed down. With forex trading now being done through mobile devices, the previously implemented manual verification procedures can’t keep up anyway. Forex companies strive to provide the fastest solutions as customers are seen to do away with services that involve delays. Instead of the slow and inconvenient manual verification, Shufti Pro’s digital identity verification provides a robust solution that allows customer authentication within seconds.

AML (Anti-Money Laundering) regulations usually vary between regions and jurisdictions to include certain additional policies and procedures. To comply with AML guidelines, forex companies are encouraged to incorporate measures and introduce policies to prevent money laundering. These procedures include background screening against global watchlists to confirm past records of money laundering and AI-based systems for monitoring suspicious account activities and reporting them to the authorities.

Customer due diligence (CDD) and enhanced due diligence (EDD) are processed to perform background checks depending on the level of risk. Shufti Pro analyzes data from the UN, OFAC, Interpol, and HMT, and also screens against lists of PEPs (Politically Exposed Persons) to eliminate risks of fraud. Not just newly onboarded customers, but also existing customers of forex companies must be subject to ongoing monitoring and due diligence.

The constantly updating landscape of AML regulations in Europe is indicated by the 6 amendments in the EU Anti-Money Laundering Directive. The 4th AMLD included an additional requirement to verify the details of UBOs and lined up with the FATF’s regulations. It also revised the description for PEPs (Politically Exposed Persons), who are considered to be high-risk individuals since they are involved with government-related roles.

Suggested read: The Changing Landscape of KYC/AML Regulations in 2021

AMLD5 included legislation for digital currencies and publicized UBO registers. The 6th AMLD became part of the national laws in Europe in December 2020, and defined liability and sanctions for those involved in the standardized crime of money laundering. The Financial Action Task Force is a global sentinel that provides recommendations for Europe’s AML and KYC regulations. The FATF’s guidelines help forex companies ensure transparency and conduct customer due diligence.

Payments Services Directive is also a regulation formulated to allow forex companies in Europe to incorporate the latest technologies in order to digitize payments. Digital records of transactions make for a relatively secure financial environment, where customers are required to go through two-factor authentication prior to making digital payments. However, transactions involving smaller amounts are not subject to these authentication checks.

The General Data Protection Regulation is legislation for the protection of personal data in Europe. Compliance with GDPR requires companies operating through AML compliance measures to reconsider some of the aspects. For instance, customer due diligence, which is a definitive step in AML compliance, requires processing personal data. Companies must, therefore, define the purpose of data collection, as the GDPR only allows it in this case. The GDPR includes instructions for not only the safekeeping but also the deletion of data after its purpose is fulfilled. AML regulations overrule this aspect of the GDPR as forex companies are allowed to keep financial records for upto five years.

Despite various efforts to implement KYC regulations in the Middle East’s forex landscape, the risks of financial crimes are still surging. Both local and international forex trading companies in the Middle East are highly regulated and involve requirements of personal data collection and storage. Identity verification of the customers is a key step in the process of customer due diligence.

The Middle East requires a few additional checks due to differences in naming conventions and transliteration challenges making the KYC system and customer due diligence difficult. Western countries have a unified naming convention with a maximum of two given names and one family name. On the other hand, the Middle East has a naming convention that includes a series of names indicating the person’s lineage. That being said, there are even differences between the naming conventions of several Arab countries within the Middle East.

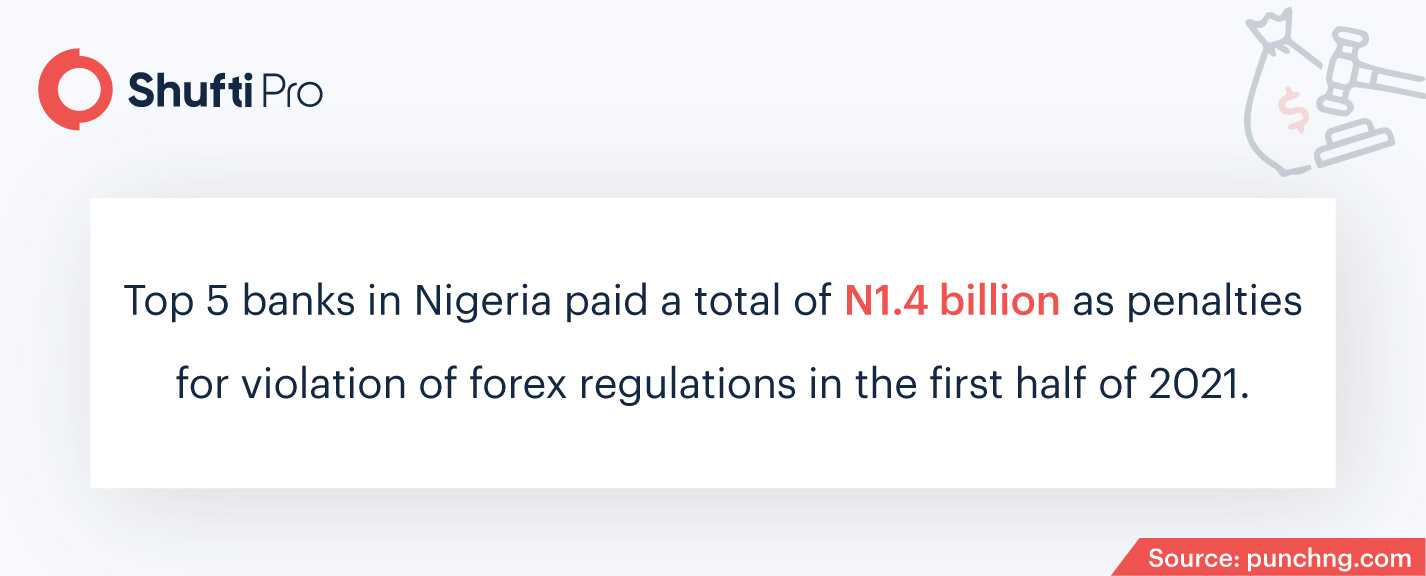

According to a World Bank report, a significant majority (81%) of the one billion people that face difficulties in proving their identity belong to Africa and South Asia. It doesn’t come as a surprise that African countries are often burdened by AML compliance fines due to the lack of satisfactory measures to verify identities, let alone customer due diligence. The challenges faced by forex companies in Africa easily outweigh those in the Middle East, as KYC compliance becomes difficult for forex companies when they encounter a number of utility bills sharing the same address information.

Know Your Customer requirements allow forex companies to verify UBOs and the intentional or unintentional involvement in criminal activities like money laundering and terrorist financing.

Shufti Pro offers AI-powered KYC/AML services for the forex industry, allowing forex companies to comply with AML guidelines and prevent financial crimes like money laundering. It verifies identities within 30 seconds and identifies high-risk entities through background screening against 1700+ watchlists.

Learn more about global KYC/AML compliance regulations for the forex industry!