AML Screening – Combating Money Laundering in Luxury Vehicle Dealings

BEFORE YOU GO...

Check how Shufti Pro can verify your customers within seconds

Request DemoNo thanks

Financial criminals usually look for priceless items like art, antiquities, as well as luxury vehicles to spend their illegally obtained funds. Unlike banks and other traditional financial institutions, high-end car dealerships and yacht companies do not have stringent Anti-Money Laundering (AML) measures in place to detect suspicious activities.

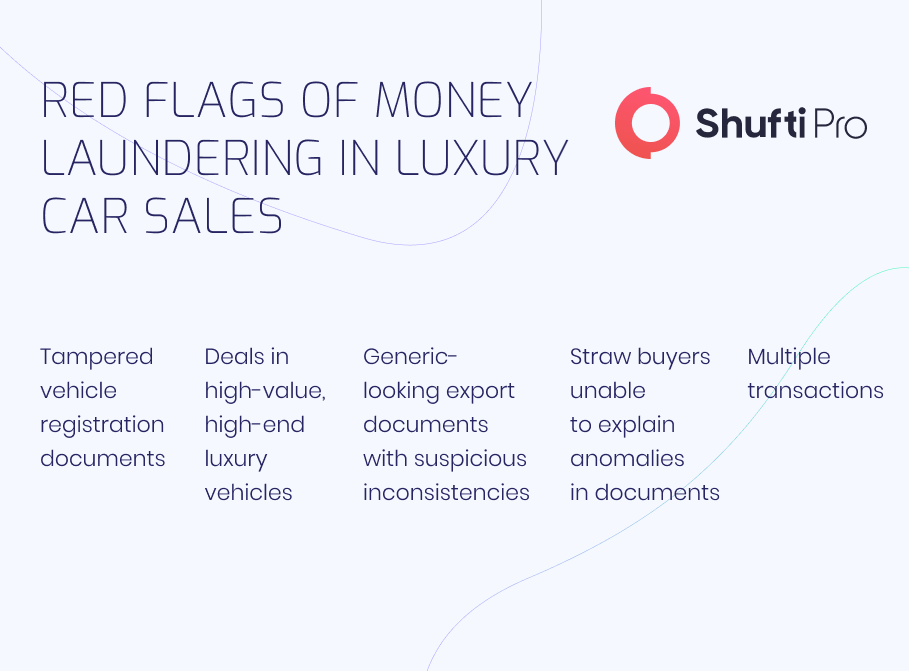

Any business or entity involved in selling high-end vehicles or yachts can risk heavy penalties and criminal proceedings if they fail to identify money laundering schemes and allow illicit funds to flow through their system. Detecting and mitigating the risks of money laundering requires car dealerships to identify the red flags and incorporate robust AML controls.

For quite some time now, the automotive sector has been a safe haven for money laundering. A common aspect of every financial criminal’s lifestyle is spending their proceeds of crime on priceless luxury items, including cars, yachts, and even private jets. These are items that allow money launderers to spend larger amounts from their proceeds of crime and, when re-sold, provide them legitimate cash. While money launderers use sophisticated methods to make it difficult for law enforcers to detect the flow of dirty money, luxury car dealerships unwillingly become participants in financial crime cases.

It’s no secret that high-end cars and yachts attract wealthy politicians, business tycoons, and Russian oligarchs by providing the perfect opportunity to spend larger amounts in one transaction. Cash payments at car dealerships mean that dirty money can directly be made part of the financial system without leaving any traces behind. Normally, the automotive export market is not regulated by financial watchdogs.

This opens the doors wide open for money launderers, as there is no one to ask for any proof or source of wealth. As luxury car and yacht dealerships are not aware of AML requirements that are followed by banks and other financial institutions, they do not pay attention to such controls. In most cases, the dealership doesn’t even know that the buyer has paid for the purchase with illegally obtained funds.

Depending on their scale and location, there are different AML guidelines that should be followed by dealers of high-end vehicles. Financial institutions and any other businesses that deal with monetary processes fall under the scope of AML regulations. The processes advised by financial regulators to prevent instances of money laundering are customer due diligence, risk analysis, and suspicious activity reporting. Although AML compliance varies from sector to sector and business to business, such measures have now become significant in the automotive sector to subdue financial crimes.

The US categorizes businesses involved in selling cars, boats, and planes as non-banking financial institutions. The law requires these businesses to comply with the same AML requirements as banks and investment firms. Similarly, Europe requires non-financial businesses that deal in the trade of goods belonging to other businesses to comply with AMLDs (Anti-Money Laundering Directives) when cash transactions exceed the threshold of €10,000.

High-end vehicle dealers in the UK and Australia are also categorized under businesses (or sole traders) that deal with transactions exceeding a specific amount.

The second money laundering report issued by the Government of British Columbia in 2019 showed that the luxury car sector had a major role in money laundering. It also made recommendations to help combat money laundering in the sector, including the manufacturing, dealing, and regulations for car dealers.

According to the report, car dealerships must be designated entities that should report directly to the Financial Transactions and Reports Analysis Center (FINTRAC) under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA). It is also mentioned that once a car dealership is designated to report to FINTRAC, it is also required to implement an Anti-Money Laundering (AML) compliance program, along with a compliance officer. Car dealerships, like banks, are required to enforce policies of staff training for the monitoring and reporting of transactions along with risk analysis.

Regardless of the regulatory regimes they are subject to, car dealerships must implement robust AML screening solutions to identify and prevent becoming a source of a money laundering scheme. Car dealerships and other institutions involved in the dealings of luxury vehicles need to implement a risk-based approach and verify their customers’ identities. By incorporating effective measures for identity verification, car dealers can determine the risk factor associated with a customer.

In high-risk cases, car dealerships are advised to adopt a more stringent approach to performing background screening of the customer. The process of Enhanced Due Diligence (EDD) involves requiring proof of the sources of money, as well as screening against global sanctions lists. This allows the business to verify whether a customer has been previously added to a watchlist for involvement in activities like money laundering or terrorist financing.

The use of AI-based solutions allows businesses to use the information of the customer to check for their presence on global watchlists, including Interpol, OFAC, and UN lists. The car dealership should also take a step ahead by performing adverse media screening to determine whether the customer has been involved in the sharing of negative content. In addition to implementing these procedures, car dealerships should also train their employees consistently to stay updated about ongoing and upcoming AML regulations that the company has to adhere to.

Training staff members enable these types of businesses to reduce the risk of corruption on part of team members and their possible involvement in money laundering schemes. Luxury car dealerships also have a requirement for reporting payments exceeding a threshold amount in any currency. After identifying that the customers’ transactions are suspicious, dealers are obliged to file a Suspicious Activity Report (SAR).

Money launderers use various sophisticated methods to obscure the origins of their ill-gotten funds. One of the convenient methods is the purchase of high-end vehicles with cash or through a car dealership to launder money. That being said, luxury car dealers need to identify and report high-risk individuals and companies using AML Screening measures.

Instead of facing the consequences of unintentionally getting involved in a money laundering case, vehicle dealerships should put aside an amount of money for implementing a robust AML compliance program. Shufti Pro’s AI-driven AML Screening solution enables car dealerships to avoid sourcing financial crimes such as money laundering to stay clear of regulatory fines and other adverse consequences.

Want to learn more about AML Compliance for your car dealership?